Authors: Tim Braunholtz-Speight, Maria Sharmina, Edward Manderson, Carly McLachlan, Matthew Hannon, Jeff Hardy & Sarah Mander

Published in: Nature Energy volume 5, pages169–177 (2020) https://doi.org/10.1038/s41560-019-0546-4

Date Published: 10 February 2020

Abstract:

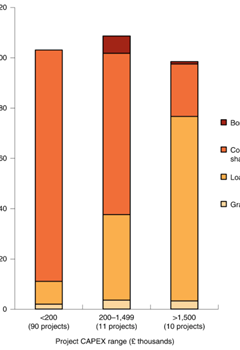

Community energy projects take a decentralized and participatory approach to low-carbon energy. Here we present a quantitative analysis of business models, financing mechanisms and financial performance of UK community energy projects, based on a new survey. We find that business models depend on technology, project size and the fine-tuning of operations to local contexts. Although larger projects rely more on loans, community shares are the most common and cheapest financial instrument in the sector. Community energy has pioneered low-cost citizen finance for renewables, but its future is threatened by reductions, and instability, in policy support. Over 90% of the projects in our sample make a financial surplus during our single-year snapshot, but this falls to just 20% if we remove income from price guarantee mechanisms, such as the Feed-in Tariff scheme. Renewed support and/or business model innovations are therefore needed for the sector to realize its potential contribution to the low-carbon energy transition.

Insights for EnergyREV:

Highlights the importance of price guarantee mechanisms in the Community Energy sector and calls for support mechanisms and business model innovation for the sector.